Where to Enter Gross Ernings Ubereats on Taxes

Understanding the Uber Eats annual summary of income for tax reports

Uber Eats is a different animal compared to other delivery apps when it comes to income reporting.

Uber Eats may report dramatically lower income on your 1099-NEC than you received. Or they could turn around and send you two 1099's, and the total is far more than you actually received.

The key to understanding this is to understand what Uber Eats reports as income, to understand the annual summary that they put out, and to know what to do with the additional income so that you don't pay more in taxes than you should be required.

Understanding what Uber Eats reports as income.

Uber Eats claims the fee they give you is higher than what you actually receive. In turn, they take back a service fee. You could call it a commission.

In years past, the "commission" was more prominent in your pay reports. If you logged in to Uber Eats and pulled up trip details you would find something like this:

At some point, Uber Eats quit putting the service fee in the trip breakdown. I think they figured out they were having to spend too much time trying to explain what it was.

But they still track it. And they still factor it into your account and your earnings report.

Using the example above, Uber Eats counts this as, your income was actually $12.67. But then you paid a Service Fee of $3.74, so $8.93 was deposited into your account.

Why does Uber Eats do things this way? None of the other delivery companies do.

There are two things involved here.

One, Uber Eats is an outgrowth of the Uber rideshare platform. Rideshare was first, delivery was added later. They still use the same app and the back end is the same.

A lot of people mix between rideshare and delivery, so they need to keep the platform and the back end of things consistent. And this is how they've always done it on the rideshare side.

The other reason is it's part of a bigger narrative Uber Eats is trying to portray through the use of a commission structure and through reporting via a 1099-K instead of the 1099-NEC (formerly 1099-MISC).

Uber doesn't want to be forced to hire employees. If it looks too much like they are using contractors like employees, they could be forced to go that route. If they can make it look like your delivery fee was paid by the customer, and that they're just taking a commission for that, it helps their cause.

Of course, they want you to ignore the fact that the delivery fees paid by customers don't line up with what is paid to the driver. That kind of defeats the narrative. That's one problem with this growing out of rideshare – it was easier to connect rideshare fees with what drivers received. But with delivery, the fee structure is different.

But if they can claim that you get paid more, and that you had to pay them a commission, it makes it look more like the customer was the one paying you and not Uber Eats.

Understand the Annual Summary

If you received any 1099's from Uber (especially the 1099-K) and the numbers don't add up with what you received, you want to open up the annual summary. It breaks down what you earned.

It's helpful to remember that, as Uber sees it, you have two forms of income:

- What you "received from the customer"

- What you received from Uber Eats.

The customer portion is reported on a 1099-K if you earned enough money. For most people, that threshold is $20,000. That amount includes the delivery fee, any surges, and any tips that were provided through the app.

The Uber portion includes incentives (boosts and quests) and any referral fees you may have received. Those are reported on a 1099-NEC if you received more than $600.

When you understand those two things, and you understand the commission or service fee mentioned above, the annual pay summary from Uber Eats makes a bit more sense.

Breaking down the Uber Eats annual income (not tax) summary.

If you log into your Uber driver account, you can go to Tax Documents and then find your tax summary.

Except I shouldn't call it a tax summary because it's not an official tax document. But it's very valuable for your tax purposes because there's one important number you won't likely find anywhere else.

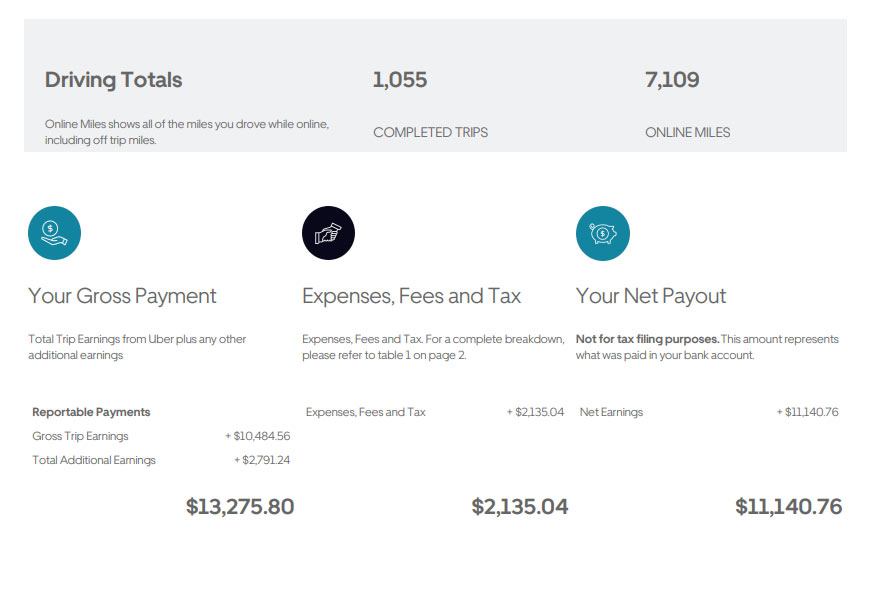

It starts off with the number of trips you took and the miles they state you drove. Personally I find these both meaningless. The miles reported here aren't going to capture all your miles, and this is not acceptable documentation according to the IRS.

Your Gross Payment

On this sample, you see two line items:

Gross trip earnings of $10,484.56

Additional earnings of $2,794.24

The gross trip earnings are the combination of delivery fees, surges and customer tips that were paid through Uber.

This is the part they claim came from the customers.

If the total here was over the threshold required in your area (in most places it's $20,000, some states require it as low as $600) then you will receive a 1099-K. Otherwise you don't receive any 1099 from Uber Eats for those earnings.

The Total Additional Earning here are the payments from Uber. This is the incentives and promotions, plus referral fees if any. It's this amount that matches what your 1099-NEC would be, if it's higher than $600.

If you've been tracking your income, you will probably find that the total amount you received is less than this.

The next section tells us why.

Your expenses, fees, and tax

Here's where Uber will report any expenses and fees they have record of.

This one is what makes this report so important, because there's a number here that's hard if not impossible to find elsewhere. It's a number that could save hundreds in taxes.

In this particular example, they list $2,135.04 for Expenses, Fees and Tax.

Page two breaks it down for you:

The print's small on this, I know.

But the breakdown is the "Uber service fee/other adjustment for $2,134.28, and then "Other miscellaneous charges" for $0.76.

Uber never tells me what that "other" 76 cent charge is. I could probably dig through all the records to find it. Maybe if it was more than 76¢.

The Uber service fee is how much they inflated the earnings you received. If this person weren't looking for this, they'd pay taxes based on the $13,275.80 in the gross earnings.

But this is a legitimate expense. You have to know about this. In this particular instance, that's nearly $600 more that would be paid in taxes if not paying attention.

We'll talk more in a moment about what to do with this.

Some other expense scenarios

I had someone forward this report that had a couple of different things.

First there was this item in his expenses.

The food cost line item was for several hundred dollars.

My first thought would be that there's been a thing where some drivers had to pay out of pocket when the payment card was declined on order and pay deliveries. This person said he had a couple, but the totals were nowhere near what Uber reported.

If you have something like that, and there's a legitimate out of pocket expense, it's worth checking to see if that amount was included in what was paid to you and reported as income.

In this particular instance, the money he received was all reported as income. There was no separate reimbrusement line item for that figure. In that instance, if it's for a legitimate out of pocket expense, it's important to uncover what that was for so you can claim it in the proper place.

On the same form, under Net Earnings he had this line item:

He had certain tolls or fees that were reimbursed to him.

Keep an eye out for these types of things. We'll talk further down about how to treat these on taxes.

The Uber Eats Net Payout Section

Finally you have this total. The net payout.

Note what Uber states in this: "Not for tax filing purposes. This amount represents what was paid in your bank account.

If you subtract the taxes and fees portion from the gross earnings, this is the amount you get.

This number should be closer to what your total amount was that you received from Uber Eats. Check this against your records, if it is dramatically different either double check your records or reach out to see if Uber Eats made an error.

Now let's talk about that "not for tax filing purposes.

How do we handle this information on our taxes?

Remember that this is not a tax document. However, it does serve as documentation. In particular, it serves as a receipt for a certain expense item.

So what should you put down for income?

There are a couple of ways you could go, especially if a 1099 was never issued.

Some will just report the money they received as their gross income.

Others will report the income as it shows up on the form and then deduct the service fees (and possibly other expenses).

Either way the net profit comes out the same.

Personally, I'm going with the latter. Even though I know the annual summary isn't a document being submitted to the IRS, I still want to just make sure my income and expenses line up with anything anyone has out there.

So here's what I would do with the example above:

I would add in the total $13,275.80 and add that to my income from Doordash and Grubhub and put that in the income side of my Schedule C.

Because the $2,135.04 in service fees is treated like Uber Eats as a commission for 'connecting me to the customers for delivery' then I'm putting this in line 10 of the Schedule C which is for Commissions and Fees.

In my opinion, it's fake income and a fake expense. But it's still being reported as income, and I don't take that lightly.

I don't think either approach will get someone in trouble either way because in the end, the net profit remains the same.

What about the reimbursements discussed above?

Whether or not you can claim something that was reimbursed to you depends one one thing: Was it counted as a reimbursement when it was paid to you or was it counted as income?

If you claimed that as income, you can claim the offsetting expense.

Now these weren't the exact items on this person's form. I decided not to use them just to protect privacy. But his numbers line up the same.

But say he had $12,000 total that were reported under gross payments, and $2,000 in Taxes and Fees. That leaves him with $10,000, right?

So now his Net earnings say $9,800 and his Reimbursement Tolls Airport Fees and Surcharges are $200.

In this instance it's not a true reimbursement.

For it to be a true reimbursement, he'd have to have received that $200 ON TOP of his reported income.

But the money he received was reported as income. The $9800 plus $200 equals the $10,000 that was left over after his reported income minus service fees.

In that situation he can claim the $200 expense

If on the other hand his net earnings been $10,000 and his airport fees/tolls etc been $200, now that's $200 on top of the reported income. THAT is a true reimbursement.

As to the food cost expense, that really depends on what that was for. He's still investigating. If he had a legitimate out of pocket cost, he can write that down as an expense in the appropriate place.

Why couldn't Uber Eats be more straight forward like the other delivery apps?

That's a good question.

Maybe because the other apps aren't trying to spin a story the same way Uber is?

Some states are actually requiring Uber to issue 1099-k's to drivers with lower income thresholds. Several just enacted that this past year.

Some drivers are in for a rude awakening.

Here's hte main takeaways:

Keep good records. Uber Eats makes it confusing enough. You want to know what you really made.

Document everything. If you have out of pocket expenses like paying for the food at a restaurant, keep a record. Keep receipts.

Don't try to do an end around on your taxes if you didn't get a 1099. Especially be cautious if you got a 1099-NEC but not a 1099-K. The IRS has received enough of these that they know that getting the 1099-NEC means you had a LOT more income that wasn't reported. They'll be looking for it to show up on your taxes.

Watch this stuff closely. Pay attention to details. It's not too difficult but just tricky enough.

And next time you hear Dara from Uber Eats tell you they're not a delivery company, you have a better idea why he's saying it.

Where to Enter Gross Ernings Ubereats on Taxes

Source: https://entrecourier.com/delivery/why-does-uber-eats-say-i-made-more-than-i-did/

0 Response to "Where to Enter Gross Ernings Ubereats on Taxes"

Post a Comment